Should You Close At The End of the Month?

A resource for agents to see if closing at the end or beginning of the month is best for their client.

Should You Close At The End Of The Month?

It is a widely held belief that buyers should schedule closing for the end of the end of the month so they can pay less prepaid interest at closing and save money. As is the case with much conventional wisdom the facts can be a bit different.

In fact, buyers don’t save money by closing at the end of the month. A month-end closing means buyers pay less prepaid interest, but skip only one subsequent monthly mortgage payment. Meanwhile, buyers who close at the start of the month pay more prepaid interest, but then skip two monthly payments. The difference between the two strategies is really one of cash flow not cash savings. A borrower gets no interest free days no matter what day of the month they choose to settle.

Closing on the last day of the month there would be one day of interest charged. When closing on the 15th of the month there will be 15 to 16 days of interest expense charged. There are other factors to consider such as at the end of some months a settlement office can resemble the King Of Prussia Mall on Black Friday. Lots and lots of activity with closing scheduled back to back throughout the day.

Cutting it too close: If a problem arises that pushes the closing to the following day you would then be settling on the first day of a new month and the entire month’s interest would then be added to the closing costs.

Back-up: Because there are often multiple closings scheduled on the last day of the month, closings may experience a domino effect. If one of the closings earlier in the day is delayed it may push back each subsequent closing to a later start time/day.

Moving Companies: Because many buyers and sellers are scheduled to move on the last day of the month, their schedules are full – it will be difficult to shop around for the best deal with the better moving companies. Your clients may be left having to pay a higher hourly rate because they are so busy.

Wire Transfers: Wire transfers of money from the lender to your title company happen multiple times per day. If your delay runs past the last wire time, your settlement may not be officially closed out until the following day.

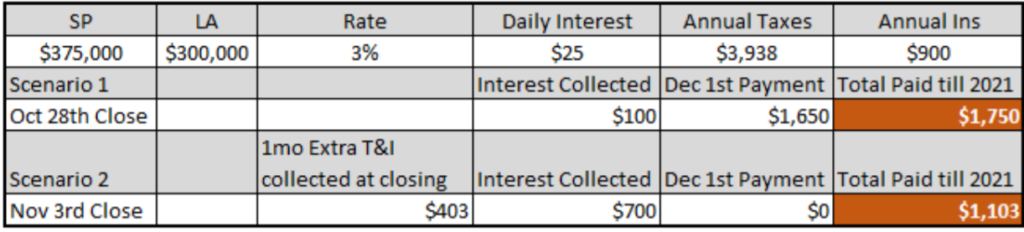

Cash flow example 10/28 settlement versus 11/3:

- Oct 28th close with 1st payment due Dec 1st shows cash flow more expensive by $647 in the table above through Dec 31st. Jan 1 and on both scenarios will be nearly identical moving forward.

- In actuality, $515 in principal would be applied from their first payment made on Dec 1st which should be factored into the overall client net benefit.

- From a cashflow standpoint closing at end of October will save clients approximately $1,003 at the table.

- Overall, the difference factoring in principal applied from closing at end of October versus early November shrinks the net down to about $132 and basically is a wash to the consumer.

Closing on the last day of the month does not save your clients money and can in fact add a layer of stress that just does not have to be there. Play it safe, receive better service from all 3rd parties, alleviate some tension, close earlier in the month and let your clients last impression of the transaction reflect the positive experience you cultivated throughout.

.png)