Approving EagleBank Deposits (Processing/ Commissions Team)

This guide will help the Processing/Commissions Team in reviewing and approving EagleBank Deposits.

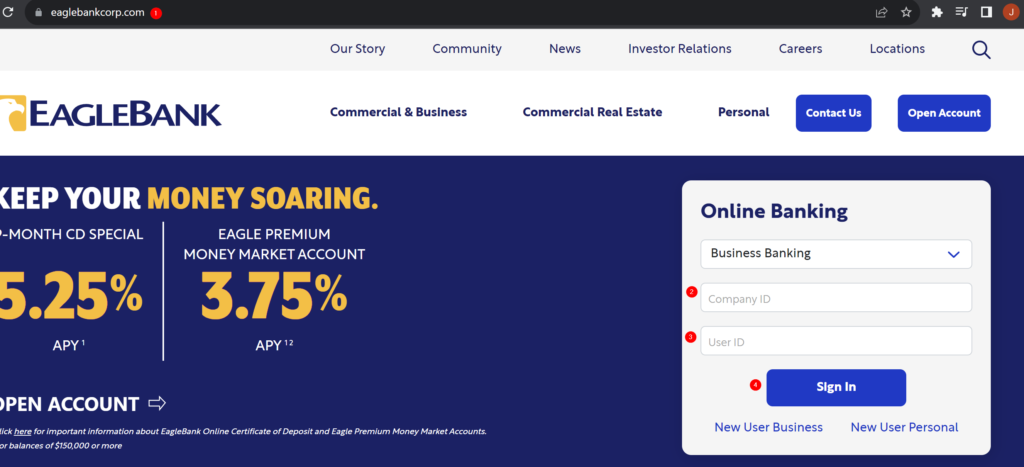

How to log in to EagleBank?

- Go to: https://www.eaglebankcorp.com/

- Enter the Company ID: 1165179

- Enter the User ID.

- Click on Sign in.

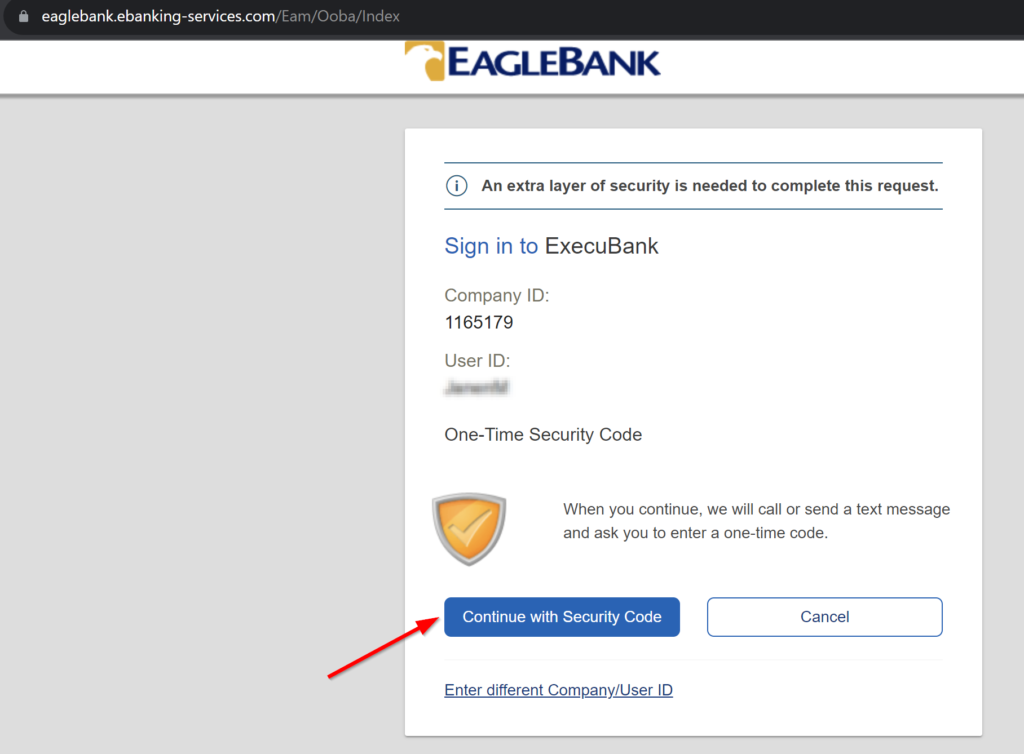

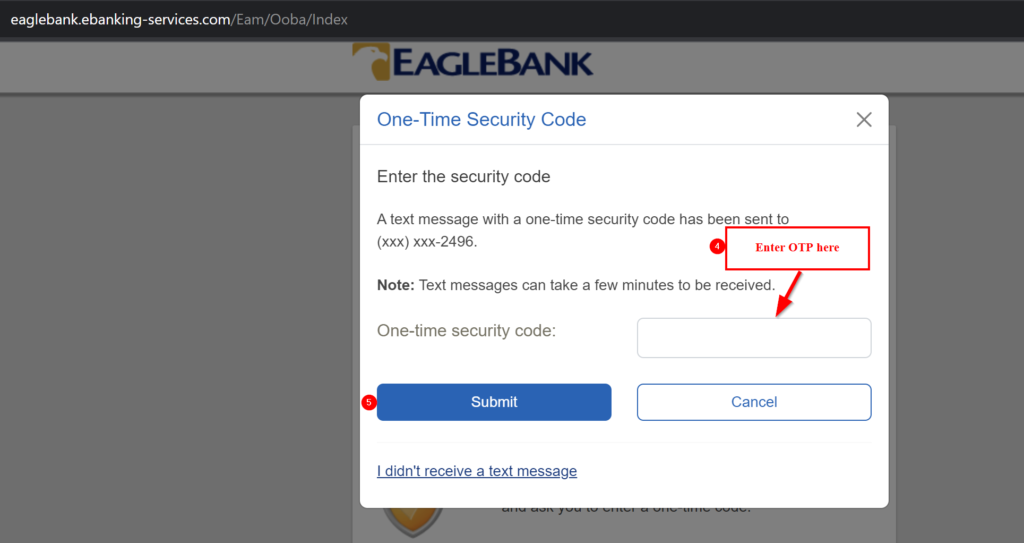

5. If it’s the first time you are logging in or if you are accessing the link from a different IP address, you will be asked to enter a One Time Pin which will be sent to your registered mobile number. For Philippines Team, the OTP will be sent to Marni’s mobile number so make sure to notify her prior to requesting OTP to make sure that she is available. Once you have the OTP, enter it on the “One Time security code” section and click Submit.

Reviewing and Approving EagleBank Deposits

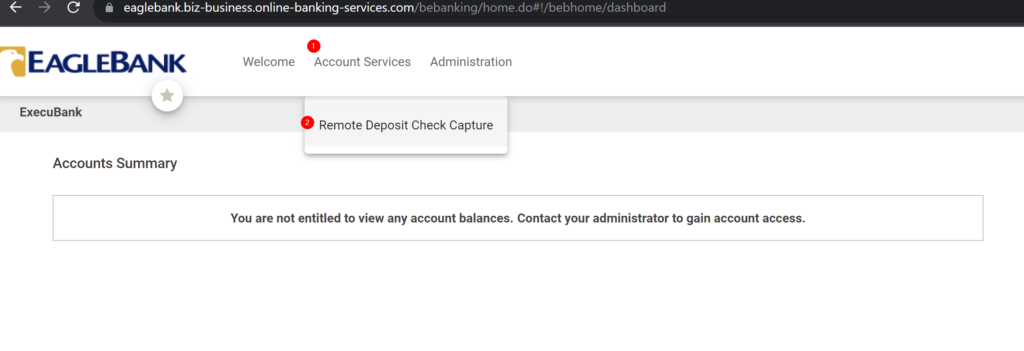

Once you are logged in to EagleBank, go to Account Services and then click “Remote Deposit Check Capture.”

If you see the alert that says “There are pending merchant deposits to review totaling $x.00” it means that the field has deposited checks that require our approval.

Under Deposits, you will see 3 tabs:

Open – These are the deposits that the field has started but may have forgotten to post. There is a huge chance that these deposits are duplicate. If the create date is 5 days earlier and it is still “Open,” notify ASM to confirm if the deposit is a duplicate and if it is indeed a duplicate, ask them to delete it.

Pending – These are the deposits that will need to be reviewed.

Recent – These are the deposits that were approved and closed recently.

Before you approve deposits, make sure to post on the Processing/Commissions Slack Channel to make sure that no one else is working on the deposits.

To approve the deposits, follow the following steps:

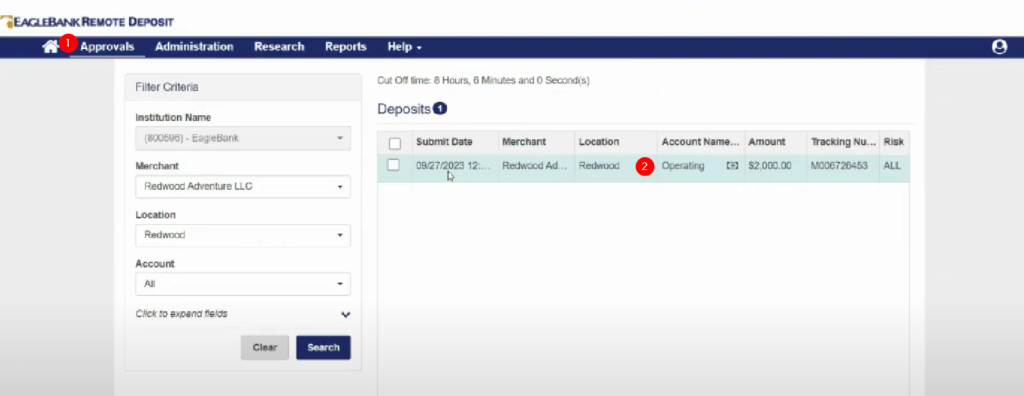

- Go to approvals.

- Then click on the deposit that you want to review.

3. You will see the Deposit Ticket. Then click on “Debit” to see the image of the check.

Before approving, check the following:

- Make sure that the check is deposited on the correct account. For commission check, make sure that it is deposited on the “Operating Account,” EMD should be deposited on the “Escrow Account.

- Check the “Pay to the “Order” section and make sure that the check is payable to Century 21 Redwood Realty, Redwood Adventure LLC or Century 21 Leading Edge. If it is payable to the Title Company or the Client, reject the deposit. If the check is payable to the Agent, check the back of the check if the agent indicated that they are endorsing the check to Redwood and if they signed it. If you see this, notify Marni to confirm if we can approve the deposit. If there is no note on the back, reject the deposit.

- Check if the amount on the check matches the amount on the deposit. If it’s not matching, reject the deposit.

- Check if there is a signature on the check. Sometimes we receive checks that are digitally signed. If you are not sure if it’s an electronic check, post it on the channel so Marni, Adria or Vic can double check.

- Check the property address associated with the deposit to confirm if the check is really intended for us. If there is no property address written on the check, use issuer’s name to search Paperless Pipeline.

4. Approve/Reject the Deposit. If you Reject the deposit, include the reason and then send an email to the ASM and provide the reason why the check was rejected.

5. Upload a copy of the Approved Deposit Confirmation to Paperless Pipelike. To do that, follow the following steps:

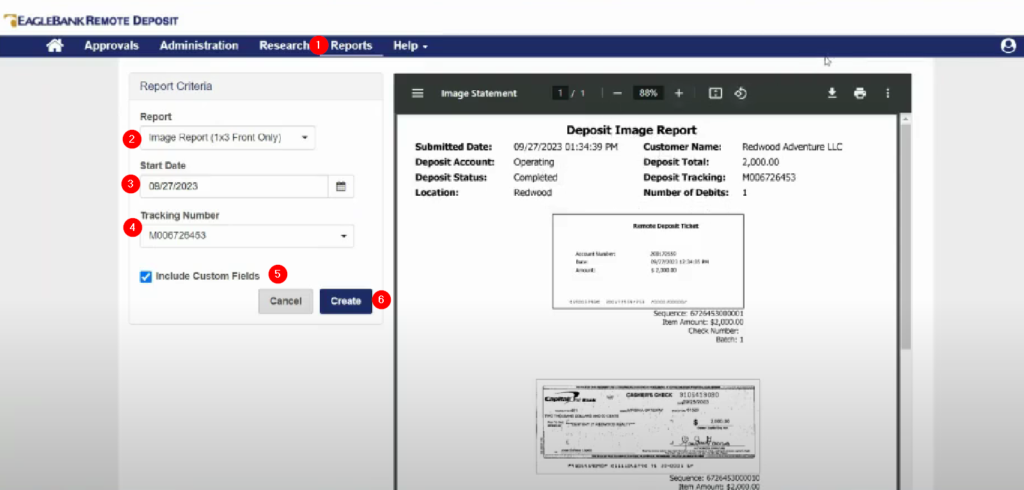

- Click Reports.

- Under “Report,” select “Image Report (1×3 Front Only).”

- Change the Start Date if needed.

- Select the Tracking Number.

- Select the “Include Custom Fields.”

- Click on “Create” and download the file.

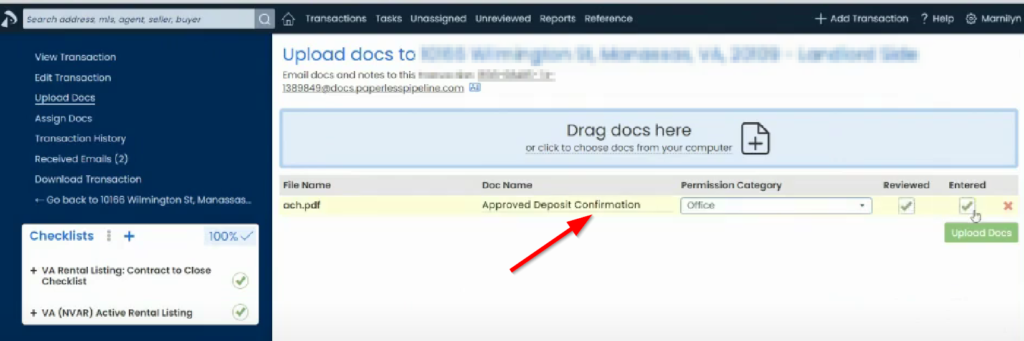

7. Upload to the corresponding Paperless file and rename “Approved Deposit Confirmation” and put it under Office docs.

.png)